February 24, 2021 at 04:02PM

The UK boasts an impressive population vaccination rate, which is already paying off: the number of new daily deaths from coronavirus fell by three times over the month and almost six times for new daily cases.

Therefore, the prospects of a complete lockdown lifting in the UK now look much more certain.

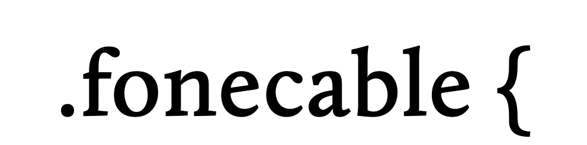

This has attracted speculative interest in the pound. GBPUSD went to 1.4237 this morning, having gained 5% in the last 20 days. The rise in the British currency is most resilient in crosses with the euro, franc and yen.

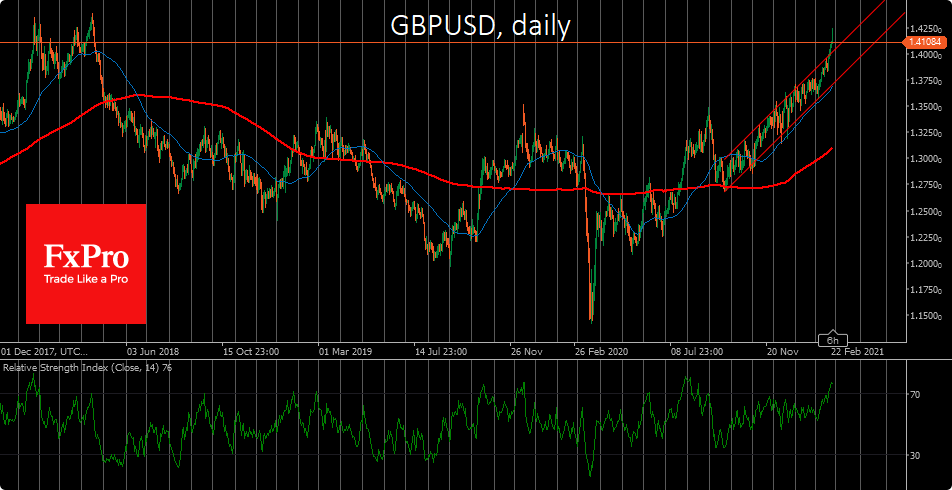

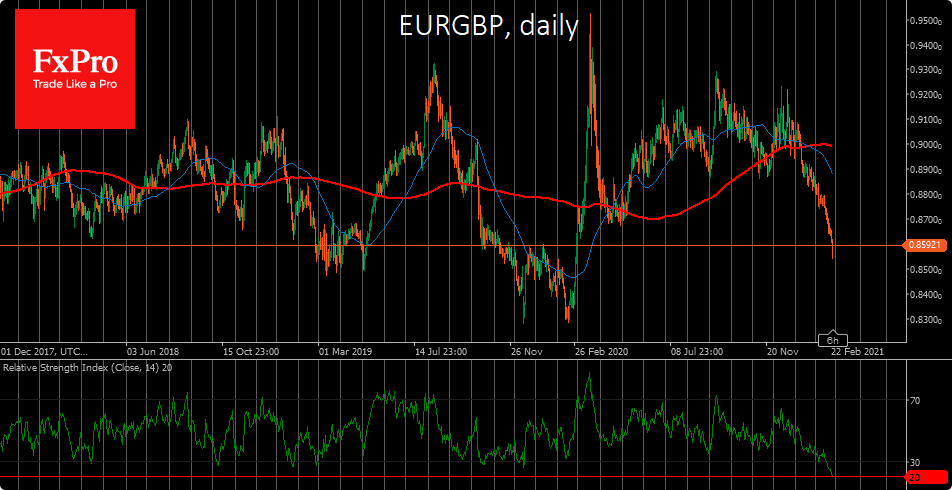

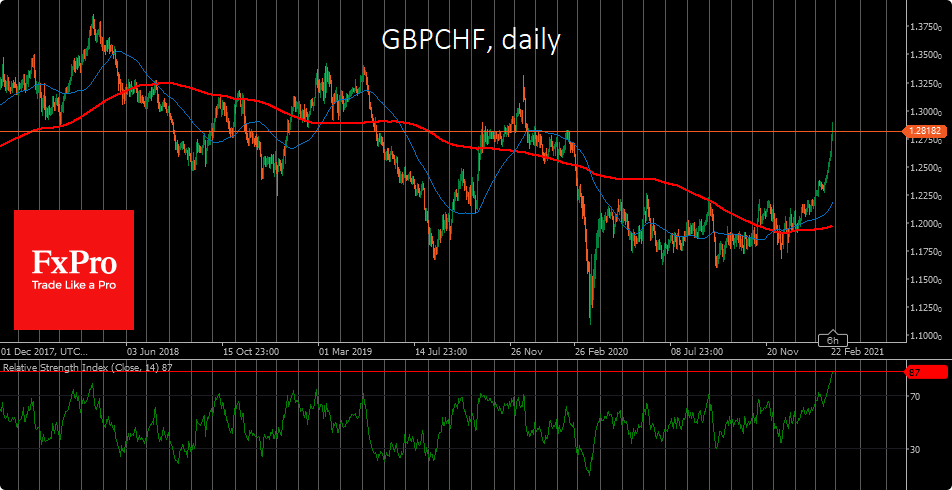

This morning there was a solid breakdown of stop orders, sending EURGBP below 0.8550 (-5% YTD), while GBPJPY was above 150 (+7.5% YTD) and GBPCHF was approaching close to 1.29 (+8.4% YTD).

The RSI index on the daily charts in these pairs exceeds 80 (20 for EURGBP), pointing to extreme overbought conditions for the pound. This very extended rally formed the base for a short-term correction, for the start of which a simple halt in the rise may be sufficient.

The FxPro Analyst Team

From: The FxPro Analyst Team https://fxpro.news/daily-economic-events/is-the-pound-rally-going-too-far-20210224/

Selected by fonecable.com

GBP/USD keeps the longest weekly rally in three years above 1.4100

|

- GBP/USD remains mildly bid, easing from intraday high off-late.

- UK Chancellor is up for an easy budget to help Britain overcome pandemic losses.

- Risk-on mood, US dollar weakness adds strength to the upside momentum.

- US Durable Goods Orders and Preliminary GDP can entertain the trades but nothing major in Asia.

GBP/USD steps back from an intraday high of 1.4150 to 1.4138 during Thursday’s Asian session. Even so, the cable prints mild gains on a day while rising for the sixth consecutive week, the biggest run-up since 2018, by press time.

While tracing the moves, the Daily Mail’s headlines suggesting easy money in next week’s British Budget are likely the key catalysts. UK Chancellor Rishi Sunak is up for presenting the annual budget statement and chatters are loud that the British diplomat will not only step back from his earlier tax-hike concerns but also take steps to make sure the economy booms shortly.

Read: UK Chancellor Sunak planning to inject the UK with a post-lockdown boom

Other than the UK budget news, the US dollar weakness and the broadly upbeat market sentiment also favored the GBP/USD bulls. The US dollar index (DXY) struggles around 90.00, the lowest since January 13, by press time. Also portraying the risk-on mood could be the US 10-year Treasury yields and S&P 500 Futures.

Global markets recently turned optimistic after the Fedpolicymakers rejected reflation fears and showed readiness to keep pumping the economy unless witnessing a sustained performance of benchmarks, like inflation and unemployment rate. The coronavirus (COVID-19) vaccines and US President Joe Biden’s push for microchip buying, as well as US covid stimulus, add colors to the positive trading sentiment.

Looking forward, a lack of major data/events can challenge the GBP/USD upside while the pre-US Q4 GDP caution may trigger the pullback moves.

Read: US January Durable Goods and Q4 GDP Preview: Consumers worry but they spend

Technical analysis

Bulls seem to get cautious off-late, as GBP/USD struggles above 1.4200, which in turn requires traders to closely watch an ascending support line from February 04, currently around 1.3975, during the pullback moves.

GBPEUR Surges Towards 1.17 as Traders Bet on Recovery

The GBPEUR exchange rate surged to almost 1.1700 as traders gave Boris Johnson the benefit of the doubt in his reopening plan. The Prime Minister’s cautious approach may be overdone, but investors are betting on the UK to outperform the EU and there is also a budget coming next week that will likely double up as a stimulus plan.

GBP to EUR is trading at 1.1665 as the pair moves further towards the April 2020 highs of 1.2000.

Traders ignore employment for budget shot in the arm

Traders in the GBPEUR ignored yesterday’s woeful jobs number from the UK, which saw the unemployment rate rising again to 5.1%. The country lost over 100k jobs this month, despite the furlough scheme being in effect. Boris Johnson has hinted that they will not “pull the rug” on the economic revival hopes and investors are now looking ahead to Rishi Sunak’s budget on March 3rd.

The Chancellor’s budget will likely act as a veiled central bank stimulus package and this will give the UK a fiscal boost while other nations are still trying to catch up on vaccines.

The UK’s own vaccination program is set to slow with a short-term dip in supplies. The number of vaccines administered in the country dropped by 30% last week as ministers warned of a supply dip, which would ensure second doses are delivered within the 12-week limit.

The UK’s health secretary said that the country could expect “a quieter week this week” for vaccinations but predicted “some really bumper weeks in March.”

Reports have also shown that vaccine administrations are being complicated by citizens requesting a particular manufacturer’s vaccine. In Europe, health officials have noted missed appointments when the AstraZeneca vaccine is being administered.

German GDP grows faster than expected in Q4

Germany’s economy grew more than expected in the fourth quarter, according to data from Destatis on Wednesday.

GDP grew 0.3% in the fourth quarter compared to expectations for 0.1%, while the full year figure was also revised up to -4.9% from -5%. Virus spending programs in Europe’s largest economy have created a state budget deficit of 139.6 billion euros, which is the country’s first deficit since 2011.

Traders are ignoring the growth figures and are preferring to focus on the future path for growth. This is giving the pound a boost as investors price in the country’s reopening plan and a budget boost. Germany has been performing well in recent data for its manufacturing sector, but the Euro is reliant on 26 other countries for its overall GDP and this is curbing any gains.

The GBP to EUR exchange rate has resistance at the April 2020 highs of 1.2000 and the pair is slowly unwinding the Brexit risk premium that emerged since the referendum.

Search Web: Is the Pound rally going too far?