November 19, 2020 at 09:33AM

The American S&P500 and Dow Jones 30 closed on Wednesday with a 1.2% decline and Asian markets are also developing a retreat from their recent highs.

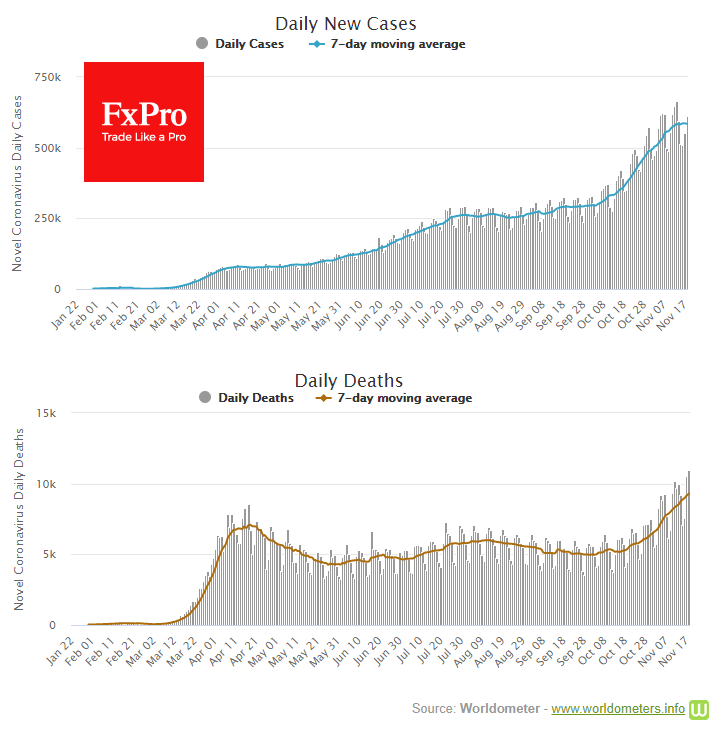

Despite the news of advances in vaccine development, markets are again paying increasing attention to new pandemic records. Daily deaths in the last two days have exceeded 10K, and the number of new cases was also above 600K. A couple of days ago, there were hopes that the peak would soon be passed, but the recent acceleration renews worries about new lockdowns in the economy. Individual states in the USA and countries in Europe are again considering the option of introducing lockdown.

In theory, this should encourage the growth of the so-called “work from home” firms but this doesn’t seem to be happening. Nasdaq100 lost 0.7% on Wednesday, slightly better than the decline in industrial Dow.

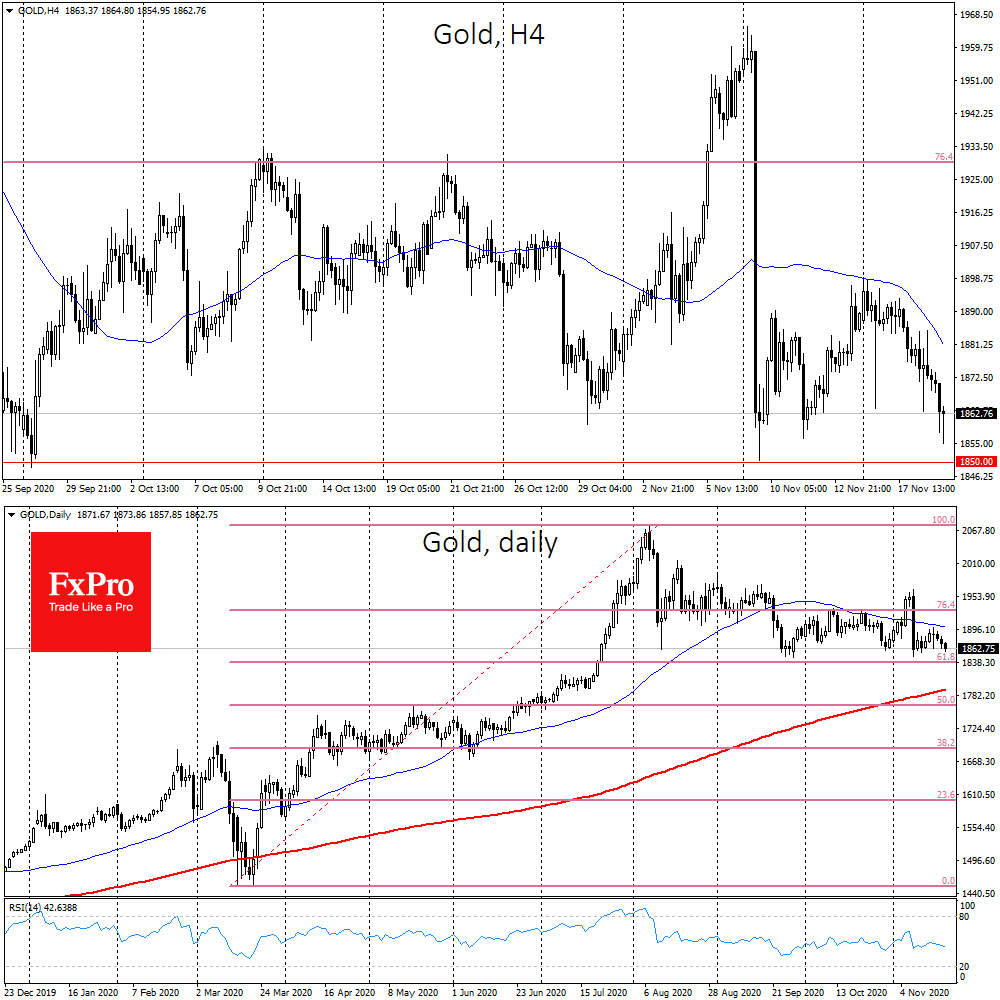

The weakening of the markets has also not benefited Gold, which has remained at the bottom of the trading range for the last four months at $1850. Gold was declining in November on both good news and bad news for stocks.

It may well turn out that the pressure on Gold is more related to profit-taking from the 12-month gold rally, as well as the traditional year-end weak gold performance from September to November.

Gold is now dominated by a pattern of ‘buying the deep’ on a decline to $1850, which is close to the 61.8% Fibonacci correction level from the March-August rally. So far, this level has saved Gold from a deeper correction. Within this pattern, the next significant growth target could be $2500 per ounce, followed by 161.8% of March-August growth.

On the side of further growth for Gold is the red-hot printing press of the U.S. and other countries. Besides, Gold has the potential to attract customer interest if market volatility increases. Investors may look again at Gold as a means of preserving capital amid uncertainty over companies’ revenues and the threat of new restrictions.

An alternative scenario assumes a support failure at $1850 to be a strong bearish signal, or even more correctly at $1800, where the 200-day average runs. In this case, buyer surrender could quickly take Gold below $1700 before the end of the year.

The FxPro Analyst Team

From: The FxPro Analyst Team https://fxpro.news/daily-forex-outlook/holding-onto-1850-gold-can-clear-the-path-to-2500-20201119/

Selected by fonecable.com

Search Web: Holding onto $1850, Gold can clear the path to $2500

Average Rating